If you work in a knowledge-based role, decision-making is an integral part of your daily responsibilities. Whether you are aware of it or not, your job revolves around making decisions.

People often fail to realize that your net worth or financial freedom is tightly related to your ability to think clearly and make the right decisions. I’ve learned that knowledge is the force multiplier for your ability to create wealth.

After spending months consuming timeless wisdom by Naval Ravikant & literature by Nassim Taleb, it is startling for me to know how much we don’t know or better, how much I don’t know.

The content I consumed so far made me realize how little I knew and how the ability to optimize your brain to ‘think‘ effectively and not memorize, has to do with the quality of life we live.

Now, let me try to categorize it, decisions fall into:

- Where outcomes can be predicted based on your knowledge & understanding.

This is the case where we are certain about the outcome or at least the range of it.

We are all good at it. For eg., If I jump out of the running car, I know it’s going to hurt. - Outcomes are difficult to predict but we could figure out the probabilities.

The better our area of competence the higher our quality of decision making. - Outcomes are unknown, and so does the probabilities.

In this case, the distribution of outcomes is unknown and the individual outcomes are necessarily unknown. This is the state of uncertainty.

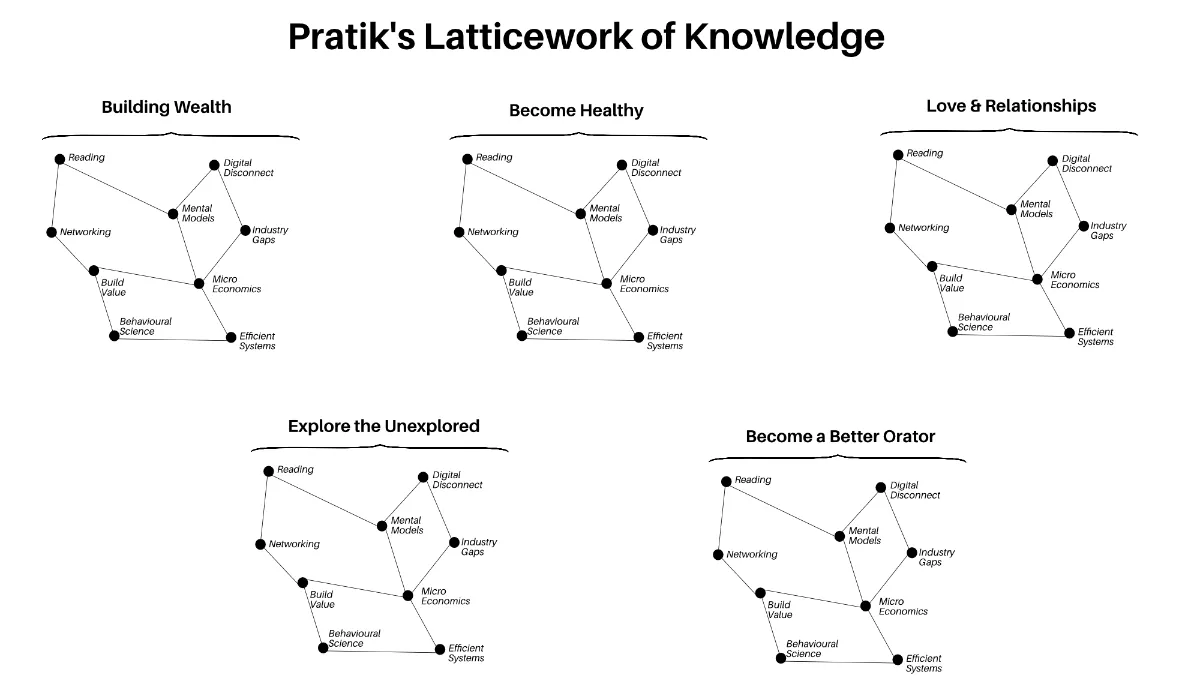

very often I assumed I am making decisions in #2, but I was wrong. More often than not, we have a limited understanding of what we know and how much we know. This is where the latticework of knowledge you’ve built across the domain helps in further strengthening the probability of making a high-quality decision.

Ignorance & Decision making

Very often we get to deal with people who would be operating in #2 from their perspective. But it becomes difficult to work with them unless they have a degree of self-realization and admission of where exactly they stand in the decision-making process.

The first group of people I’ve come across are ridiculously smart founders or colleagues who know their limitations of knowledge and wouldn’t shy away from admitting if they don’t know something, or it’s out of their area of competence. I’ve always loved to work with this kind.

The second group of people would never admit what they don’t know. They would be excited to take the decision only to realize they were wrong all along and they would be too ignorant to let the expert suggest otherwise.

I’ve covered more about it, Fragilista by Nassim Taleb.

How accurate are the risks?

Let us understand the decision-making process in the majority of corporates today.

We would often see corporate decision making process being starting and ending with charts and PPTs.

1. Identify the future desired outcome

2. Make power point presentations and charts supporting the proposed decision by an individual.

3. Based on weighted probabilities, make a decision.

One of the major problem with this approach is the risk analysis done, the matrices that conclude the analysis and also the personal biases involved while making the analysis.

The organisation I’ve been a part of, these charts are rarely discussed in detail from multiple dimensions and become more about checking the ‘I thought about risk’ or ‘as per my experience’ box than anything else. We conveniently pin things into categories of low, medium, or high risk with a corresponding “impact” scale.

We put most of our attention to high-impact metrics, rightly so. But, should we not consider factoring in the other people’s biases?

Is a person’s perspective to see or identify risk would always be rational?

How often we might be missing on the unrealized opportunity cost because someone weighted the risk incorrectly?

Surprisingly, we cannot even identify everything and account for everyone’s biases. We rarely go back to identify how accurate the power point presentations were, once we have reached a certain outcome.

Ignorance

- Known Ignorance:

Often this type is good, because people practicing this ignorance knows that they are being ignorant but the admission of it is either suppressed by ego or their personal insecurity. - Unknown Ignorance:

This is often what leads to bad decisions, catastrophic outcomes and in extreme cases, toxic environment & demotivated staff.

This also reminds me of a quote from Antifragile by Nassim Taleb:

[Unknown Ignorant]defaults to thinking that what he doesn’t see is not there, or what he does not understand does not exist. At the core, he tends to mistake the unknown for the nonexistent.

Antifragile by Nassim Taleb.

Rational decision making becomes harder as we move along the continuum:

outcomes are known —> risk —> uncertainty/ignorance.

If we can not consider all possible outcomes, preventing failure becomes nearly impossible. Further complicating matters, situations of ignorance often take years to play out and this level of rationality is extremely difficult to achieve as well.

So, what is the way out?

Well, there is no way out and nor its meant to be, by nature of probability. Our best bet is to often avoid people who practice #2 ignorance and always promote the one’s who wouldn’t shy away from developing their own latticework of knowledge in order to make a sound decision.

We can only increase the probability of getting the desired outcome right when we consider the risk beyond concentrated power points and considering individual biases.